Product Manager’s guide to building Product OKRs and identifying KPIs

Introduction:

High performance organizations differentiate themselves by being razor focused on what’s important for long term success and sustained competitive advantage.

Objective and Key Results (OKRs) and Key Performance Indicators (KPIs) are what enable companies to develop this focus and prioritize ruthlessly. OKRs and KPIs also help in communicating shared goals to align teamwork and drive accountability.

For example: Let’s say your company’s objective is to achieve $1 billion annual recurring revenue (ARR) by the end of this financial year. Therefore, one key result for the first quarter could be to achieve $250 million in subscription revenue. In simple term revenue is # of customers * average revenue per customer therefore to achieve objective of $1B ARR you would want to be on top of two KPIs: # of customers and avg. revenue per customer. Being razor focused on these two KPIs to deliver quarterly results will help you achieve your company’s annual objective.

Objectives can be abstract such as be the market leader, be the most respected company, be the most trusted company, and be the most customer centric company. However, Key Results and KPIs should be specific and measurable. Objective is long term whereas Key Results are time bound and specific.

OKRs and KPIs provide you the superpower to be razor focused on what matters the most for your company and your customers and avoid distractions.

Expected outcome from this blog:

As a data driven product manager, I strongly believe in Peter Drucker’s quote “If you can’t measure it, you can’t improve it.” When I started as Product Manager, I naturally tried to come up with a list of important things to measure and improve. I read a lot of blogs and articles on product KPIs, which lists KPIs like DAU, MAU, churn rate, revenue, ARR, NPS etc but I struggled to find an article which provided me a framework to think about the most important KPIs for my product. Working in the B2B product space made this challenge even worse because most of the generic KPIs are for B2C products and don’t translate directly to my industry and product.

My goal for this blog is to help product managers think about KPIs and OKRs in a structured way and apply the framework discussed in this blog for different products and industries (even niche ones).

Foundation Framework:

Traditionally organizations’ north star goal is to maximize shareholder’s value. Organizations generate shareholder value by capturing part of value they create for the customers.

Our job as product managers is to create value for customers by creating products which remove customer’s pain points and delight customers by getting their jobs done. Customers in turn will pay for the product based on their willingness to pay for the perceived value the product provides.

The figure below shows value creation and value capture framework. With time and evolution of technology products move from one quadrant to the next.

As product managers our focus should be to continuously deliver more values to the customers which helps in developing sustainable competitive advantage for the company and remaining in the high value creation and high value capture quadrant (#2). In this blog I will share framework to build OKRs and identify KPIs to achieve objective of being in quadrant #2.

Deep Dive on identifying KPIs to drive key results:

Value Creation:

A successful product company creates value for customers by solving their pain points and helping customers get their jobs done. The more important the job is and the more underserved the customer needs are the more value the product creates for the customers.

Mapping out the customer journey and evaluating critical product capabilities throughout the customer journey helps us identify product KPIs for customer value creation.

For example let’s consider a generic customer journey and critical product capabilities:

- Register/Install/Deploy the product: This is the first step in customer journey. Successful products make this step friction free and super easy for customers. Some of the KPIs for this step are:

- % of successful install

- % of users completing the registration process

- Dropout rate in registration process

- Time taken to complete registration or install the product

- Steps needed to complete registration or install the product

- # of support cases and questions raised for registration or installation of the product

- Initial configuration of the product: This is more common for enterprise B2B products. After initial installation of the product customers need to do initial configuration of product before they can start using it. Some of the KPIs for this step are:

- Time taken to complete initial configuration of the product

- Steps needed to complete initial configuration of the product

- # of support cases and questions raised for initial configuration of the product

- # of customers who completed initial configuration / # of customers who downloaded the product

- % of successful initial configuration

- Dropout rate during initial configuration

- Operation: This is one of the most critical phases of customer value creation. This is where detailed understanding of customer’s jobs to be done and the full process for how to get it done becomes important. Aligning product operations with functional and non functional user needs gives a framework to come up with user operations related product KPIs. Let’s look at non functional customer requirements and relevant product KPIs for that.

- Availability: Unless services that the product provides are available customers can not use the product. In industry this is generally measured as x.9s availability (9.99% as 3.9s).

- Reliability: Reliability is the ability of the product to perform intended function consistently and correctly. There is a subtle difference in between availability and reliability – a service can be available but not reliable. Measuring error rates and # of support tickets for specific features provide a good mechanism for measuring reliability of the product.

- Performance: Performance KPIs provide insights into whether the product meets and exceeds customer’s performance needs or not. KPIs for performance varies from use case to use case. For example – performance KPIs for storage products in public cloud such as AWS – EBS or Azure managed disks, or GCP Persistent disks are – IOPS, throughput, and latency. For backup and recovery product performance KPIs are recovery point objective, and recovery time object. A more generic example performance for KPI for instagram will be – time to upload an image or video, time to submit a comment, time to submit a like, time to share a post etc.

- Scalability: Successful growing products and services see demand grow over a period of time. Scalability allows systems to adapt to growing needs to meet growing demand. Throughput like transactions per second (TPS) and capacity such as GB or PB are good KPIs for scalability of the product.

- Usability: This indicates how easy the product is to operate. Usability KPIs should cover effectiveness, efficiency and satisfaction of the UX.

- Completion rate

- Number of errors

- Task time

- Task clicks

- Task level user rating and satisfaction (subjective and qualitative)

- Supportability: Supportability KPIs provides insights into ease of resolving customer issues and product evolvability needs (for example version upgrade). Some KPIs to track for supportability:

- Mean time to resolution of customer issues

- Version adoption

- Time taken to upgrade/update

- Steps taken to upgrade/update

- % of successful update/upgrade

- Monitoring & Notification: Monitoring and notifications enable customers to be informed about the status of application. Monitoring and notification provides customers information to take proactive or reactive actions to different events. For example robinhood app provides a way to monitor price or different stocks and crypto. Users can use this information to make investment decisions.

- Security & Privacy: Security and privacy are fundamental needs of the customers. It’s not only mandated by some of the government data privacy laws but it also ranks consistently in one of the most critical buying criteria used by customers.

- Total cost of ownership (TCO): Customer evaluates product on its perceived value vs TCO and not cost of the product. TCO includes licensing cost of the product plus all other expenses needed to run and maintain the product. Product adoption depends on the customer’s perceived value Vs TCO. For example TCO for public cloud storage products like AWS EBS, Azure managed disk and GCP persistent disk can be measured as $/GB. In advertising relevant KPIs are cost per acquisition, cost per conversion, and customer acquisition cost.

Value Capture:

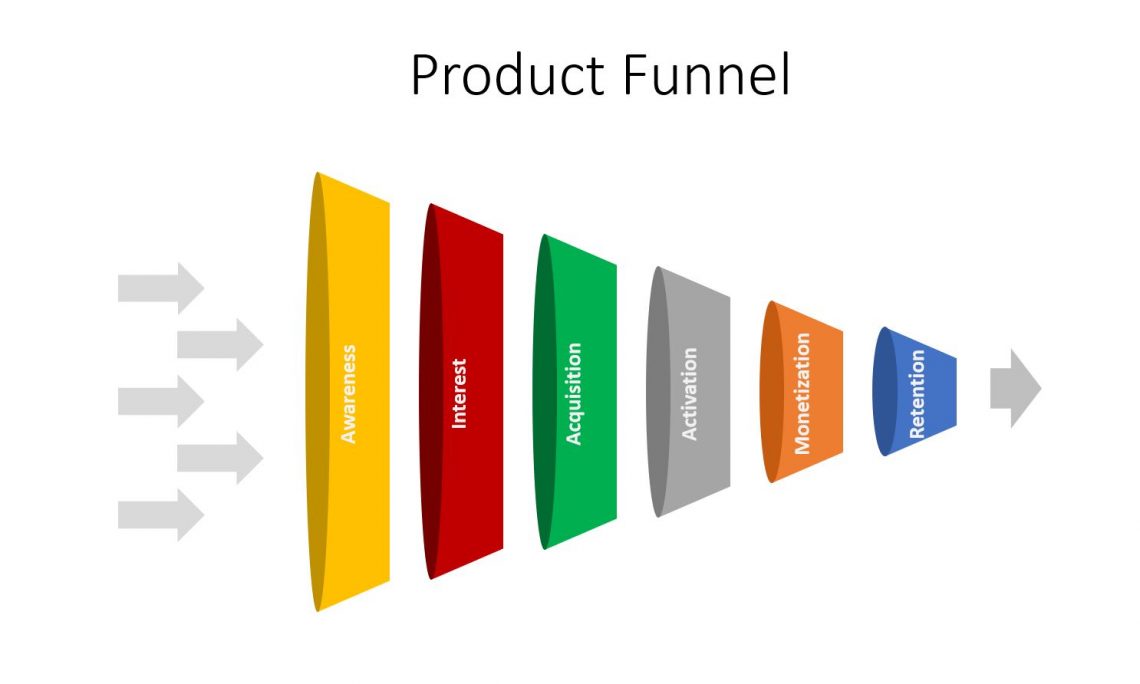

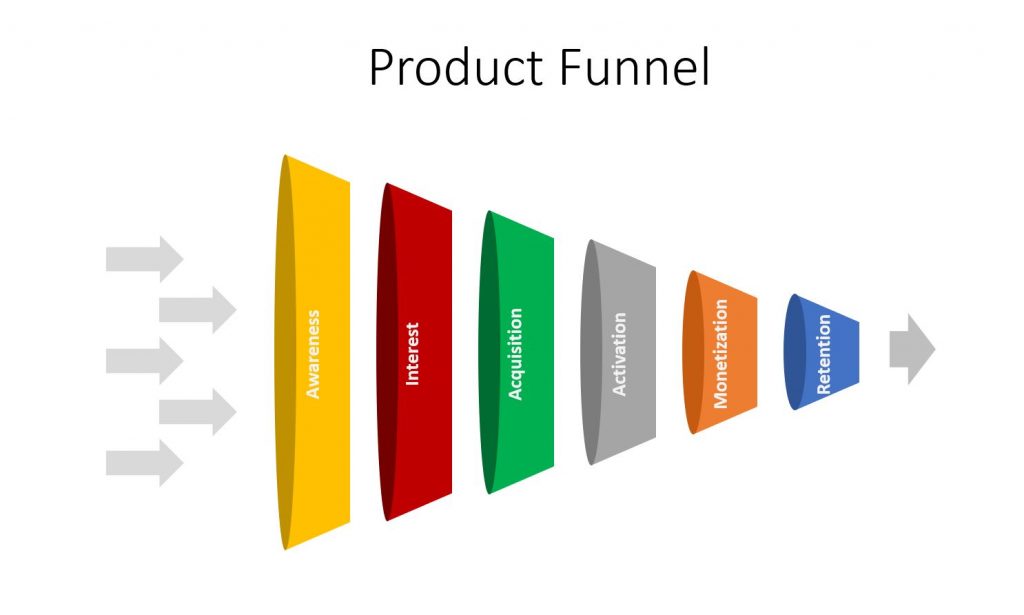

A lot of organizations try to maximize value capture and focus on profit formula for the business. As product managers we should look at value capture through Product adoption funnel:

- Awareness: This is the top of the product adoption funnel. Some KPIs for product awareness are:

- Product impressions

- Website traffic

- Search volume data

- Product awareness survey

- Social media engagements

- Lead generation

- Product Mentions

- Interest: Once a potential customer becomes aware of your product and its value proposition then the customer may decide to further explore or try the product. Some KPIs for interest phase of product funnel:

- # of downloads

- # of queries received from customers

- # demos

- # of POCs

- POC success rate

- # of beta customers

- Beta success rate

- # of deals in the pipeline

- $ in pipeline

- Acquisition: In this phase a potential customer converts into a real customer of the product. Some KPIs for Acquisition:

- # of customers

- Segmentation of customers based on geography, use case and scale

- Activation: There is a subtle difference between acquisition and activation. Some customers download and install the product but don’t use it. This signals that the product may not be meeting the customer’s needs. Some KPIs for activation:

- Daily active users

- Monthly active users

- % of active user

- # of inactive customers – shelf ware

- Monetization: Monetization refers to how a product is generating revenue for organization. Some monetization KPIs to keep track of:

- $ revenue

- Customer lifetime value

- Annual recurring revenue

- Monthly recurring revenue

- Average deal size

- Average % discount

- Win loss ratio/Close ratio

- Cart abandonment

- Check out abandonment

- Average cart size

- Cost per acquisition

- Pipeline conversion rate

- Average length of sale

- Retention: Retention metrics show repeat customers. A low retention rate might be a signal of poor customer experience. Some KPIs for retention phase of product adoption are:

- Net Promoter Score (NPS)

- Customer Satisfaction (CSAT)

- Churn rate

- Referrals

- # of repeat customers

- % of repeat customers

- Retention rate

- Reference:

If you are focusing on growing and scaling your product it is recommended to focus on strengthening the product adoption funnel from retention to awareness (bottom to top) and not in reverse order (top to bottom). Unless you have a good retention ratio, acquisitions processes and monetization processes increased awareness will just lead to higher number of inquiries and low conversion rate.

Closing thoughts:

I hope by going through each phase of value creation, customer journey, value capture and product adoption funnel you can adapt this framework to your specific industry and product.

Not all KPIs are equally important therefore identify the most important objective for your product and corresponding KPI.

Please do let me know your feedback and comments about the framework discussed on the blog.

Further Readings and References:

Following articles and books helped me understand OKRs and KPI and come up with this blogs. Idea shared in this blog comes from several books and articles which are mentioned below. I highly recommend reading following books and articles:

- Measure What Matters by John Doerr

- Strategy for Start-ups by Joshua Gans, Erin L Scott, and Scott Stern

- Know Your Customers’ “Jobs to Be Done” by Clayton M. Christensen, Taddy Hall, Karen Dillon, and David S. Duncan

- Reinventing Your Business Model by Mark W. Johnson, Clayton M. Christensen, and Henning Kagermann

- The Innovator’s Dilemma by Clayton M. Christensen

- Decode and Conquer: Answers to Product Management Interviews by Lewis C. Lin

- The Lean product playbook by Dan Olsen

- Hooked: How to build habit forming products by Nir Eyal and Ryan Hoover

- University of Southern California Marshall School of Business MBA Classes:

- BAEP 557 – Technology Commercialization by Prof. Pai-Ling Yin

- MKT 543 – Market Demand and Sales Forecasting by Prof. Sivaramakrishnan Siddarth

- MOR 564 – Strategic Innovation – Creating new markets by Prof. Violina Rindova

- MKT 536 – Pricing Strategy by Prof. Shantanu Dutta

2 Comments

Amit Kumar

What can be OKRs and KPIs for platform products; product which act as Horizontal cutting across multiple product lines?

Alok Abhishek

Hi Amit,

OKR is driven by the company’s goals and objectives. Product’s OKR should align with that. For example. If a company wants to scale to 1 million daily active users then how can the product help in achieving that objective? There is a good analogy in the book, ‘Measure What Matters’ which is very well summarized here.

As for the KPIs. I would say a good product manager tracks KPIs which covers product value creation for customers and not just what is needed for tracking OKR. Not all KPIs have the same importance but having information of different KPIs helps in making product decisions over the long run. So track all the important KPIs even if it does not directly relate to the OKR.

AS for the internal platform type product. The OKR will still need to align with the company’s OKR and need for different product teams and business units the platform servers. I would think of platform products as a product which serves several different customer segments with slightly varying needs. Instead of end customers the platform product should treat different Business units as different customer segments.

I hope that helps.

Thanks, Alok