Competitive Analysis framework for Product Managers

Introduction:

To build a successful product, product managers need to develop an in-depth understanding of all 4Cs (customers, company, competitors and collaborators).

Finding reliable information on competition is a difficult and time consuming task. In absence of detailed competitive information a lot of teams fall back on feature parity analysis. I am sure you have seen competitive analysis tables, showing competitors in columns and features in rows with red cross or green check marks. These tables provide insights on feature parity which might be useful but can often mislead product teams in chasing feature parity (a moving goal post) and not differentiation.

For a product manager, a good competitive analysis is about developing actionable insights on how to achieve sustainable competitive differentiation and deliver unique customer value. A good competitive analysis also helps in enabling sales and marketing to correctly position the products and handle customer’s questions.

In this blog, I share a framework to approach competitive analysis which will provide actionable insights to build better products.

Competitive analysis framework:

As with any project it helps to start with an end state in mind. As differentiation is key to the success of the product, in this blog I will focus on competitive analysis to build product differentiation.

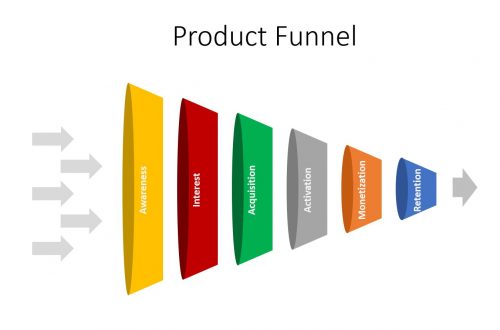

We can break down competitive analysis in four key phases namely industry analysis, identification and segmentation of competitors, value chain and business model analysis and product capabilities analysis. Let’s dive deeper into each of these four phases.

Industry Analysis:

The importance of knowing the industry well can’t be overstated. Industry analysis helps in making informed decisions about product strategy. Michael Porter’s five force analysis is a widely used framework for industry analysis. Five forces constituting this framework are:

- Threat of new entrants: Barriers to entry, cost of exit and expected retaliation from incumbent companies forms foundation of industry’s attractiveness to new entrants. The threat of a new entrant is high in an industry with low barriers to entry, low cost of exit and low probability of retaliation from incumbents. If you are part of such an industry you might be part of a highly competitive industry or you can expect a lot of new competitors to enter this market. In such an industry it is very important to keep an eye on competition. Incumbent companies with dominant market share should look for ways to increase barriers to entry for new competitors. Economy of scale, high capital requirements, complex legal/government policy requirements, and unequal access to distribution channels are some of the ways to increase entry barriers.

- Threat of substitutes: A substitute product uses different technology to solve customers’ needs. A lot of times these kinds of competitive threats go under the radar until it is too late to take action. Camera industry is a very good example of this. First film cameras were replaced by digital cameras (films were replaced by digital memory cards) and then consumer digital cameras were replaced by mobile phones. Currently we see customers transitioning from internal combustion engines to electric motor engines. Similarly in the technology space we see customers transitioning from traditional on premises IT infrastructure and deployment to Cloud computing (and SaaS delivery model).

- Bargaining power of customers (buyer power): In an industry where customers have many alternatives and low switching cost they also tend to have a lot of power to put firms under pressure. These pressures could be price pressure or demand for specific features. Product managers should build in differentiation and high switching cost to mitigate the risk of unreasonable buyer pressure.

- Bargaining power of suppliers (supplier power): Suppliers of human resources, raw material, services and components constitute source of supplier power. While building a product (especially hardware products) product managers should plan to avoid dependency on a single vendor for specific components. In high tech industries attracting highly skilled engineering talent is tough and therefore companies should build human resource practices to attract top talents.

- Competitive rivalry: When there are a lot of competitors in an industry it tends to lead to cut throat price wars and commoditization of products. Product managers in such industries should try to differentiate their products.

Total addressable market (TAM), compounded annual growth rate (CAGR), and complementors are additional factors to consider while doing industry analysis. An industry with large TAM and high CAGR is often attractive for new entrants. Complementors have a symbiotic relationship with the industry and product. For example, advancement in data analytics technology and prevalence of data visualization and analytics tools has made data the most strategic asset for companies. This has resulted in explosive growth of data and therefore need for data storage and data warehousing products.

Following is my analysis of the cloud computing industry.

With overall TAM of over $250B (IaaS, PaaS and SaaS) and a CAGR of over 30%, no doubt the cloud computing industry looks so attractive.

Identify and segment competitors:

Product Managers should start this phase of analysis by creating a comprehensive list of all competitors. Industry and analyst reports, and talking to sales and marketing is really helpful in getting a 360 degree view of the competitive landscape and creating a comprehensive list of direct and indirect competitors.

Once you have the comprehensive list segment the competitors in following four segments:

- Traditional incumbents

- Niche and emerging startups

- Disruptors

- Frenemy (partners who are competitors as well)

A lot of times niche emerging startups and disruptors go under the radar because in the beginning they target the lower end of the market (by offering lower performance at a low price point) and therefore are not perceived as potential threat to upmarket customers, which are the core focus of the company. However, with time some of these competitors improve performance to meet upmarket customer’s needs with low cost structure. Therefore it is advised to study the business model of new emerging startups and keep an eye on the rate of performance improvement compared to the pace of customer’s performance improvement expectations.

Some industries may have a lot of competitors and it might be difficult to thoroughly analyze all competitors. In such scenarios you should select top competitors in each of these four segments for further analysis.

Value chain and business model analysis:

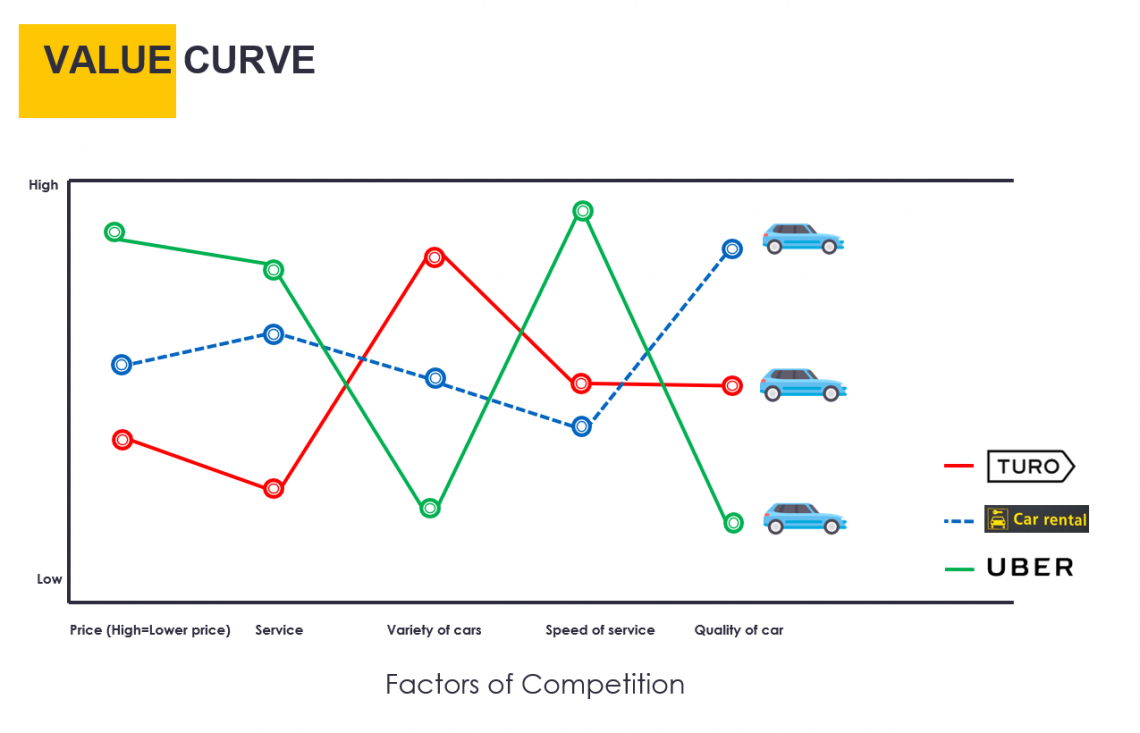

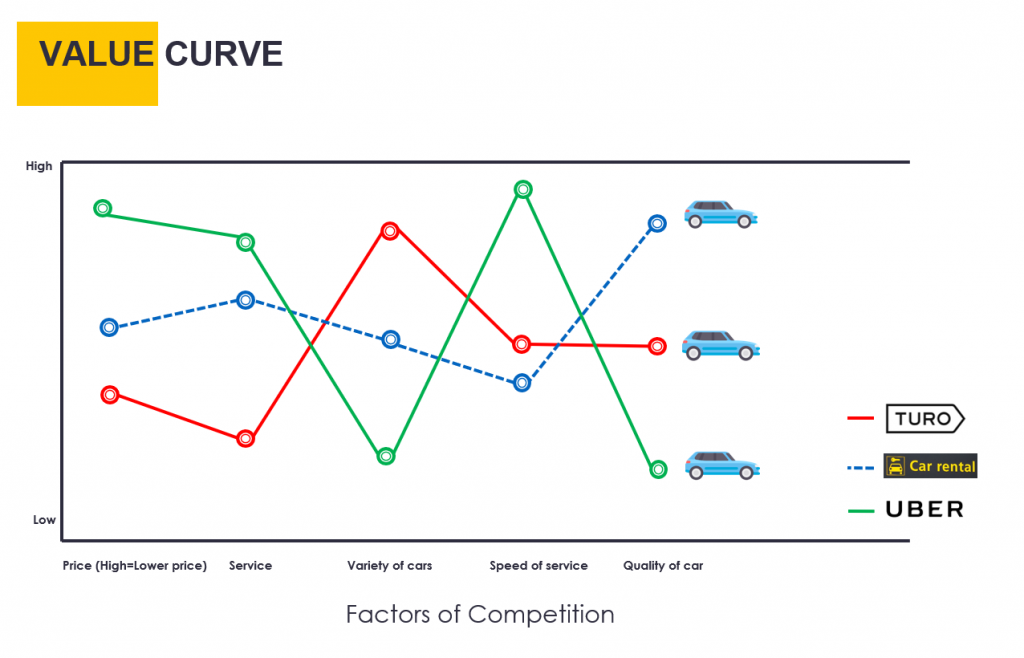

In the context of financial management, the goal of a firm is to maximize shareholder’s value. A firm maximizes shareholder’s value by capturing part of the value it creates for the customers. Value chain is a set of activities a firm performs in order to create and deliver customer value. Business model is the building block of sustainable competitive advantage. By overlaying the value chain and business model canvas you can create a value curve for your specific industry.

This will provide an insight into factors of competition in an industry and competitive profile of a company relative to others in the industry.

For example, here’s my value curve analysis of car rental (and taxi) companies.

Value curve clearly shows the current state of competition in industry and what values customers receive. By leveraging four actions framework (raise, create, reduce and eliminate) you can identify underserved customer needs, create new value curves and disrupt the market. One thing to keep in mind is the importance of focus and differentiation. Firms that try doing everything generally end up stuck in the middle and not do anything well.

Product capabilities analysis:

This is one of the most critical parts of competitive analysis and it should also be most familiar to most product managers. At the beginning of this phase I highly recommend mapping out the customer journey for your product and then identifying critical product capabilities which customers value throughout their journey. Talking to customers, and sales and doing survey analysis (conjoint analysis is very useful for this kind of analysis) is a good starting point for identifying critical product capabilities. While doing this analysis be careful to avoid getting into feature parity analysis.

I will illustrate this by analysing block storage offerings provided by main cloud computing providers. Although there are several other block storage providers in the cloud, I will focus on block storage offered by Amazon Web Services (AWS), Microsoft Azure and Google Cloud Platform (GCP) namely Amazon Elastic Block Store (Amazon EBS), Azure managed disks and GCP persistent disks for this analysis.

As I go through different phases of customer journey (provision, configure, operate, monitor, secure and govern) for block storage, following are critical capabilities that customers value the most:

- Usability: This covers ease of use during provisioning, configuration, update and monitoring. Customers use UI, APIs and SDKs to perform these actions therefore this section looks at support for UI, APIs and SDKs as part of usability.

- Total Cost of Ownership (TCO) or cost: Data is growing at an exponential rate and customers often tend to make tradeoffs between the cost of block storage and its performance. For this we will look at $/GB and $/provisioned IOPS as main parameters to evaluate different block storage options. None of the cloud providers offer features like thin provisioning, deduplication and compression which makes this analysis simpler.

- Performance: Throughput (MB/S), latency and IOPS are the main criteria for the performance pillar.

- Reliability, availability and durability: This covers the failure rate, x9s of availability, redundancy (and replication) to avoid data loss and persistence of data.

- Scalability: In addition to the capacity limits this also looks into support for auto scaling capabilities and ability to attach to multiple VMs.

- Security: This covers areas such as encryption and data protection (snapshots and backups). Compliance with regulatory requirements (FIPS, HIPAA, ISO etc.) could be another area to consider.

- Ecosystem support: Block storage is only part of customers’ requirements. Customers look at the overall ecosystem (compute, network, workload support and other value added services) provided by the cloud service provider to choose the cloud vendor.

Based on data publicly available at this time following is my analysis of block storage options provided by AWS, Azure and GCP.

Not all factors of competition in value chain analysis and critical capabilities in product analysis are valued equally by customers. Conjoint analysis is a valuable tool to understand the relative weight customers put on these attributes. Relative weightage will also vary depending on the customer segment. For example, for a B2B product small and medium size business segment might be more sensitive to TCO whereas a large enterprise customer may be more interested in high reliability and performance. Based on your target customer segment and target market share I recommend building a weighted average scorecard for the product versus other competitors.

Outperforming competition on all attributes across the board is not possible therefore you should focus on core attributes which are most important to your target customer segment. Most of the attributes also follow the rate of diminishing return principle. Beyond a certain threshold, the perceived customer value generated by marginal improvement in a specific attribute will not add to further differentiation of the product.

How to use the information from competitive analysis:

Competitive intelligence can be best exploited by incorporating information from competitive analysis in following areas:

- Product strategy and planning: It is recommended to incorporate competitive intelligence early in product planning by socializing the information with engineering, sales, and marketing. Identify weakness in competitive offerings and areas in which you need to catch up. Incorporate these findings into a product roadmap which will help differentiate your product from its competition.

- Pricing strategy: Value based pricing is based on the customer’s perceived value and willingness to pay. Competitive analysis provides critical information to assess product differentiation and customer’s perceived value which then contributes to assessing willingness to pay and coming up with pricing strategy.

- Product Launch: Targeting and positioning is highly influenced by competitive alignment of your product. Leverage the competitive intelligence to correctly position your product in the market, build value proposition which resonates with the customers, and target the customer segment who value the differentiation the most.

- Sales Battlecard: Training sales to effectively compete with competitors is crucial. Information gathered from competitive analysis should be leveraged in offensive and defensive guidelines for the sales. Sales battle card should arm the sales team with information about strengths and weaknesses in a competitor’s product as well as how to rebut or overcome these. Battlecard should also proactively provide sales with common customer questions and concerns and how to address them.

Tracking overall market share and periodically performing win/loss analysis is a good way to measure effectiveness of competitive intelligence gathered.

Closing thoughts:

In today’s fast evolving technology sector competitive analysis needs to be refreshed periodically. Maintaining competitive advantage is like racing in a formula 1 race and maintaining lead over other competitors all the time.

I hope this blog provides you valuable information on how to approach competitive analysis. When done well, competitive analysis can be a source of invaluable insight and contribute to your product strategy and plan.

Please let me know your feedback and thoughts about the competitive analysis framework discussed on the blog.

Further Readings and References:

Following articles and books helped me understand competitive strategy and come up with this blog. Idea shared in this blog comes from several books and articles, some of which are mentioned below. I highly recommend reading following books and articles:

- Competitive Advantage: Creating and Sustaining Superior Performance by Michael E. Porter

- Competitive Strategy: Techniques for Analyzing Industries and Competitors by Michael E. Porter

- The Innovator’s Dilemma by Clayton M. Christensen

- Gartner Magic Quadrant

- Seizing the White Space: Business Model Innovation for Growth and Renewal by Mark W. Johnson

- Business Model Generation: A Handbook for Visionaries, Game Changers, and Challengers by Alexander Osterwalder and Yves Pigneur

- University of Southern California Marshall School of Business MBA Classes:

- MOR 564 – Strategic Innovation – Creating new markets by Prof. Violina Rindova

- GSBA 540 – Contemporary issues in competitive Strategy by Prof. Peer Fiss